working capital turnover ratio calculator

WC Turnover Ratio Revenue Average Working Capital. A high working capital turnover ratio indicates that management is highly efficient in using the companys short-term assets to support its sales.

Fixed Asset Turnover Ratio Formula Calculator Example Excel Template

The working capital turnover ratio is the proportion of net sales to working.

. A higher-than-average working capital turnover ratio indicates that every pound or dollar of working capital spent. It is very easy and simple. A higher ratio indicates greater efficiency.

An online financial calculator for net working capital turnover calculation which is defined as the ratio of net sales to working capital. Working capital turnover ratio. This means that for every one dollar invested in working capital the company generates 2 in sales.

A high working capital turnover ratio also gives the company an edge over its competitors. Working Capital Turnover Ratio Example. For example if a company makes 10 million in sales during a calendar.

Startup Funding Revenue-Based Financing. 420000 60000. Ad HSBC Has a Range Of Solutions To Help You Self-Fund Growth Expand Your Business Reach.

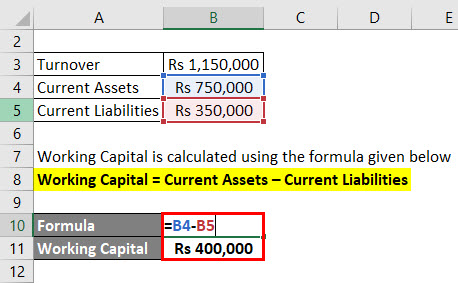

Its turnover ratio is calculated as follows. Current Assets and Current Liabilities. You can easily calculate the Working Capital using the Formula in the template provided.

What is the working capital turnover ratio for Year 3. Putting the values in the formula of working capital turnover ratio we get. A high turnover ratio indicates that management is being extremely efficient in using a firms short-term assets and liabilities to support sales.

The working capital turnover ratio is an efficiency metric that measures how effectively a business turns its working capital into increased sales numbers. In general a high ratio can help your companys operations run more smoothly and limit the need for additional funding. How effectively short-term resources are being used for sales is evaluated using the working capital turnover ratio.

Now working capital Current assets Current liabilities. 2000000 in average working capital 12000000 in net sales. Working capital turnover ratio formula.

This company has a working capital turnover ratio of 2. Working capital turnover is a measurement comparing the depletion of working capital used to fund operations and purchase inventory which is then converted into sales revenue for the company. Working capital turnover ratio 60.

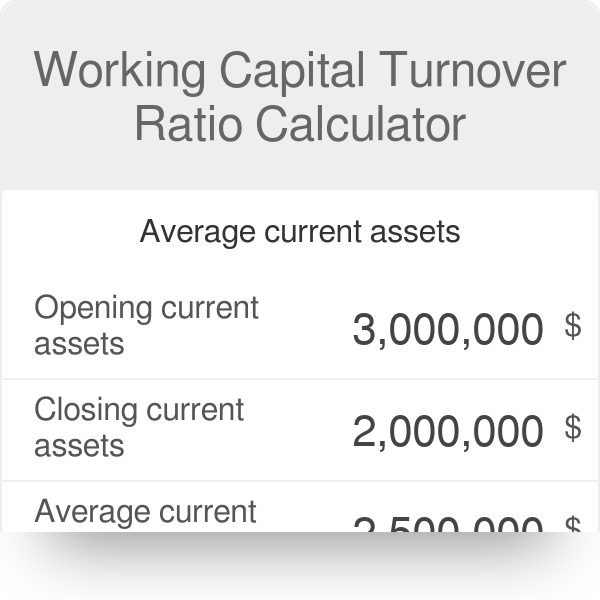

100000 40000. If your organization has 500000 in current assets and 300000 in total current liabilities your working capital is 200000. First lets calculate the average working capital.

This means that for every 1 spent on the business it is providing net sales of 7. WC dfrac 100 000 180 000 2 140 000 latex Now we can calculate the working capital turnover ratio. The formula to measure the working capital turnover ratio is as follows.

Working Capital Turnover Ratio Issues. Working capital is calculated by subtracting a companys total liabilities debts from its total assets. Since we now have the two necessary inputs to calculate the working capital turnover the remaining step is to divide net sales by NWC.

Interpreting the Calculator Results If Working Capital Turnover increases over time. Once you know your working capital amount divide your net sales for the year by your working capital amount for that same year. In the below working capital turnover ratio calculator.

The calculation would be sales of 320000 divided by average working capital of 22000 which equals a working capital turnover ratio of 145 times. Average working capital would be the average of 20000 and 24000. This is known as the working capital turnover ratio.

Working Capital Current Assets Current Liabilities. You need to provide the two inputs ie. ABC Companys net revenues over the last twelve months totaled 12000000 with an average working capital of 2000000.

The working capital turnover ratio measures how well a company is utilizing its working capital to support a given level of sales. The resulting number is your working capital turnover ratio. In reality the ratio measures how efficiently your money is working to generate more capital.

Working Capital Current Assets - Current Liabilities. Working Capital Turnover 190000 95000 20x. Information about your total liabilities and your total assets can typically be found on your balance sheet.

About Working Capital Turnover. Working capital Turnover ratio Net Sales Working Capital. An increasing Working Capital Turnover is usually a positive sign showing.

To arrive at the average working capital you can sum. Check out our trade and receivables financing options. We need to calculate Working Capital using Formula ie.

Working capital turnover compares the proportion of net sales to working capital. Balance SheetA balance sheet is one of the financial statements of a company that presents the shareholders. The working capital ratio transforms the working capital calculation into a comparison between current assets and current liabilities.

The working capital turnover ratio measures how efficiently a business uses its working capital to produce sales. Now that we are aware of what Working Capital and Turnover are we can understand the Working Capital Turnover Ratio. From the 20x working capital turnover ratio we can conclude that the business generates 2 in net sales for each dollar of net working.

The Working Capital Turnover ratio measures the companys Net Sales from the Working Capital generated. Working capital can be calculated by subtracting the current assets from the current liabilities like so.

Working Capital Turnover Ratio Formula Calculator Excel Template

How To Calculate Your Working Capital Turnover Ratio

Asset Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Formula Calculator Excel Template

Efficiency Ratios Archives Double Entry Bookkeeping

Working Capital Turnover Ratio Calculator

How To Calculate Working Capital Turnover Ratio Flow Capital

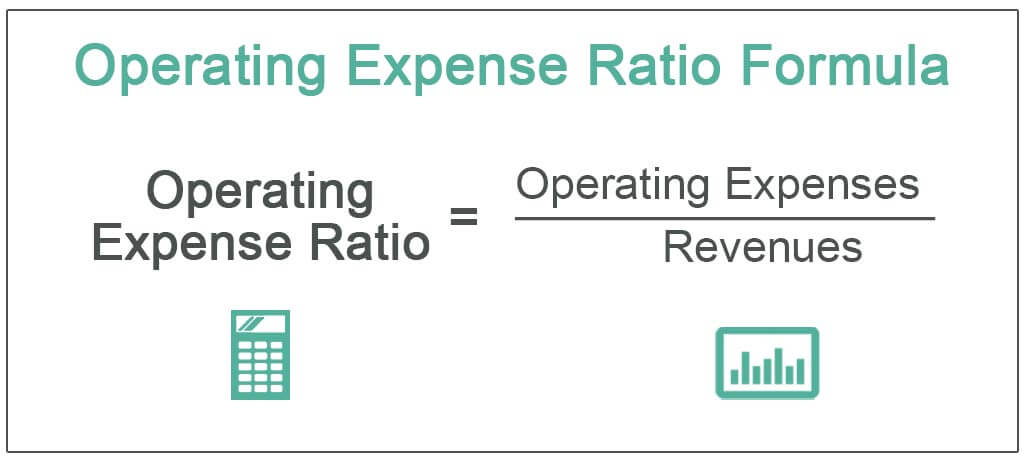

Operating Expense Ratio Formula Calculator With Excel Template

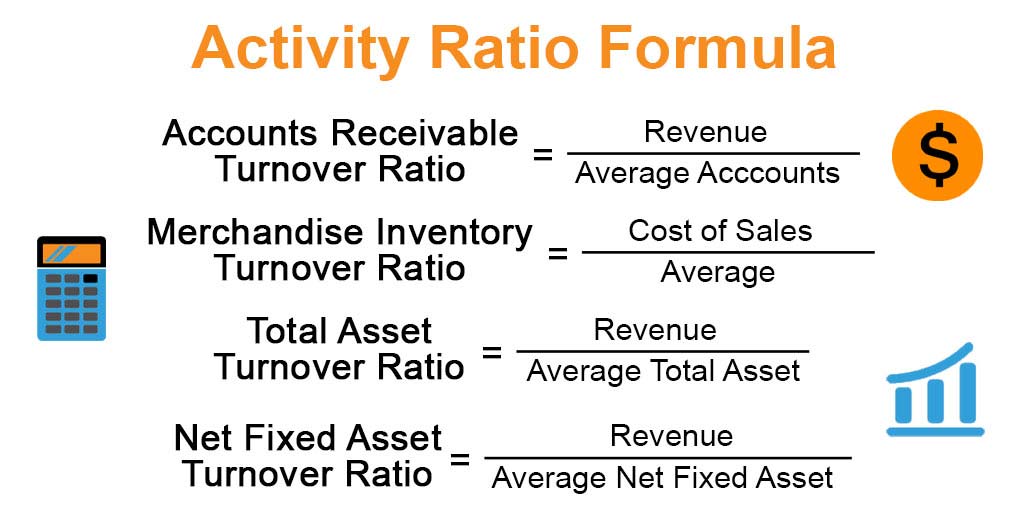

Activity Ratio Formula And Turnover Efficiency Metrics

Working Capital Turnover Ratio Formula And Calculator

Working Capital Turnover Ratio Meaning Formula Calculation

Activity Ratio Formula Calculator Example With Excel Template

Asset Turnover Ratio Formula And Excel Calculator

Working Capital Turnover Ratio Formula And Calculator

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

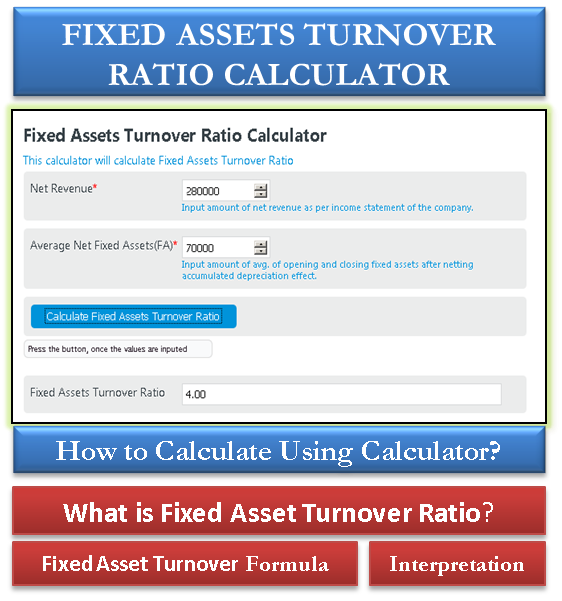

Fixed Asset Turnover Ratio Calculator With Formula Interpretation Efm